tax strategies for high income earners 2021

Before we get into the various tax reduction strategies for high income earners its important that you understand the basics of taxes. The maximum allowable contribution for 2021 was 19500 but for 2022 the cap has.

Tax Planning For High Net Worth Individuals

This is one of the most important tax strategies for you as a high-income earnerIf properly structured family trusts or partnerships can help you.

. Dont discount the wealth-generating potential and flexibility an HSA can afford. For 2021 the standard deduction is 12550 for single filers and married filing separately 25100 for joint filers and 18800 for head of household. You are allowed to put in.

Explore a free investment check-up and see where you are on your path toward your goals. An overview of the tax rules for high-income earners. Complete our form today.

High-income earners make 170050 per year. Its possible that you could. Invest more in your retirement accounts and avoid selling assets.

A Solo 401k for your business delivers major opportunities for huge tax. Qualified Charitable Distributions QCD 4. Contribution limits as of 2021 are 3600 for individuals 7200 for families and 1000 for 55 catch-up.

Invest in Tax-Free Savings Accounts TFSA Among the best tax strategies for high income earners is to. Trial Tax Return. Download the free Definitive Guide to Retirement Income for 500k portfolios.

Explore a free investment check-up and see where you are on your path toward your goals. A Solo 401k can be the single most valuable strategy among all the tax saving strategies for high income earners. Thats important to understand because you might assume that high-income earners are people making 400000 500000 or more each year.

Easily manage tax compliance for the most complex states product types and scenarios. If you have a high-deductible insurance plan you can put some of your money in Health Savings Accounts for retirement and medical purposes. Potential changes coming up the legislative pipeline could also.

Ad Tax Strategies that move you closer to your financial goals and objectives. Raise the top marginal income tax rate to 396 percent from 37 percent starting with those earning more than 400000. Washington State recently enacted a tax on extraordinary profits from the sale of financial.

Income splitting and trusts. Its estimated that 90. Morgan Advisors get to know you and your financial goals.

Tax Planning Strategies for High-income Earners. Complete our form today. Wealth preservation tax code strategies to reduce income and capital gains tax.

We will begin by looking at the tax laws applicable to high-income earners. Mon - Fri. 1441 Broadway 3rd Floor New York NY 10018.

1 day agoHigh earners have long chosen states with low or no income tax. Max Out Your Retirement Account. Another one of the best tax reduction strategies for high-income earners is to contribute to a retirement account.

Ad Accurately file and remit the sales tax you collect in all jurisdictions. 6 Tax Strategies for High Net Worth Individuals. We recommend doing a trial tax return before year-end to assess your tax implications thus allowing for current year action to maximize tax opportunities.

You can do so tax-free up to. Morgan Advisors get to know you and your financial goals. Florida gained the most high-income filers in 2020 followed by Texas.

We provide guidance at critical junctures in your personal and professional life. First lets start off with the federal income. As a high-income earner you may feel comfortable about your ability to cover out-of-pocket medical costs.

Ad Approach retirementwith an informed investment income plan. E-File Your Tax Return Online. How to Reduce Taxable Income.

Remote work has amplified the trend. Here are helpful tax strategies for high-income earners that help increase savings. 5 strategies to minimize taxes for high income individuals.

There are seven tax brackets for most ordinary income for the 2021 tax year. Five Tax Strategies for High Income Earners Report this post.

Tax Strategies For High Net Worth Individuals Save Money Invest Reduce Taxes Mackwani Adil 9781734792621 Amazon Com Books

Tax Strategies For High Net Worth Individuals Save Money Invest Reduce Taxes Mackwani Adil 9781734792621 Amazon Com Books

Irmaa 2021 High Income Retirees Avoid The Cliff Fiphysician Com Higher Income Income Tax Brackets

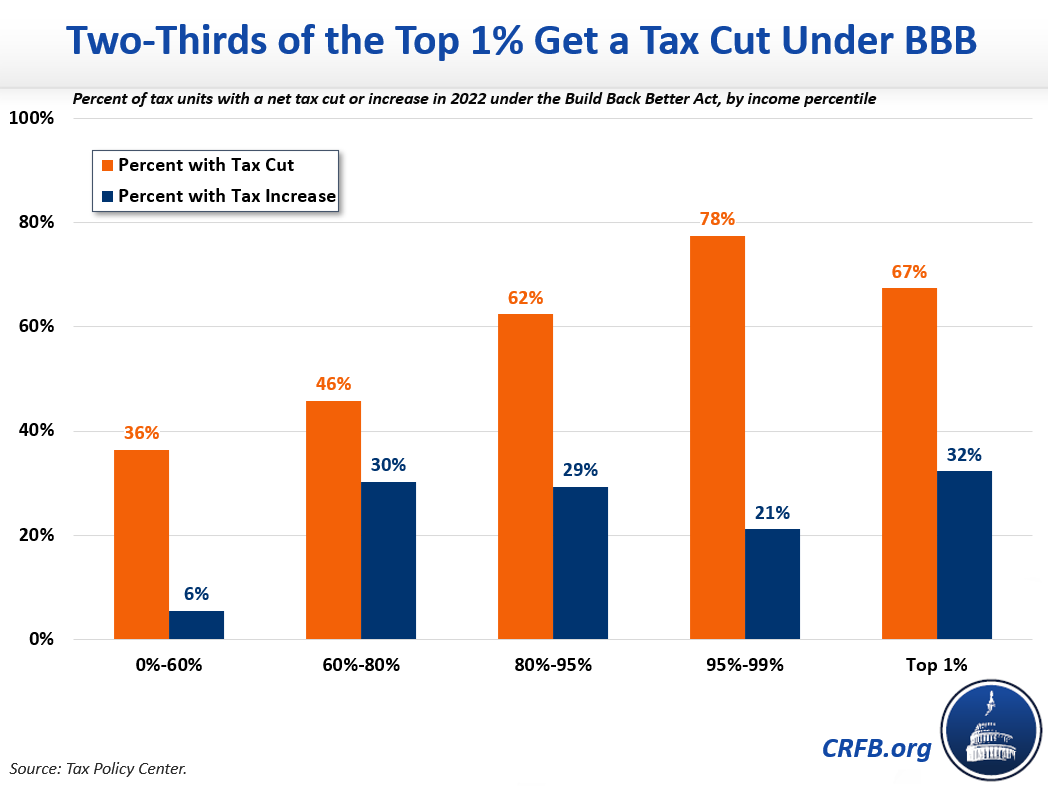

Two Thirds Of The One Percent Get A Tax Cut Under Build Back Better Due To Salt Relief Committee For A Responsible Federal Budget

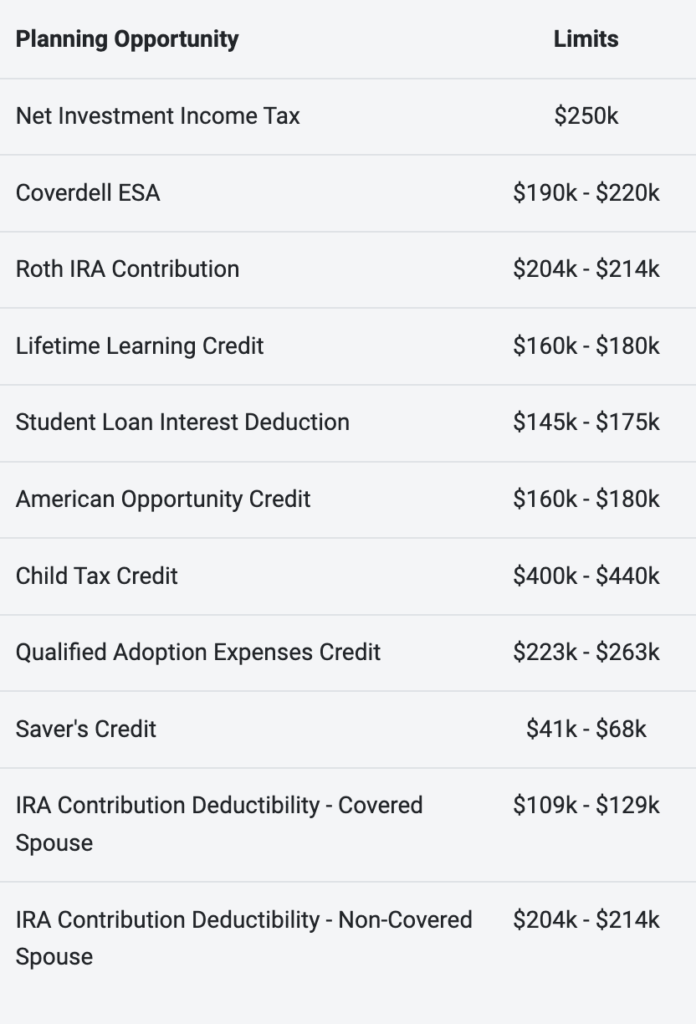

9 Ways For High Earners To Reduce Taxable Income 2022

5 Outstanding Tax Strategies For High Income Earners

The Hierarchy Of Tax Preferenced Savings Vehicles

Tax Strategies For High Income Earners 2022 Youtube

7 Smart Ways High Earners Can Prep For A Smoother Tax Season Wingate Wealth Advisors

6 Strategies To Reduce Taxable Income For High Earners

Tax Strategies For High Net Worth Individuals Save Money Invest Reduce Taxes Mackwani Adil 9781734792621 Amazon Com Books

5 Outstanding Tax Strategies For High Income Earners

10 Tax Planning Strategies For High Income Earners Gamburgcpa

The 4 Tax Strategies For High Income Earners You Should Bookmark

Tax Strategies For High Income Earners Wiser Wealth Management

Tax Strategies For High Income Earners Taxry

2021 Tax Changes Biden S High Income Families Income Capital Gains Taxes Proposal

Tax Strategies For High Income Earners Wiser Wealth Management